The Networth formula is quite simple

Networth = Assets – Liabilities

So, if you have assets of Rs. 2 crores and your liabilities are 50 lacs, your net worth is Rs 1.5 crores.

We have always been taught to calculate networth this way and there is nothing wrong with that, however, it’s a very simplified version of calculating your net worth, which does not give any kind of insights or information to you.

A lot of times, you may also get the wrong impression about someone because of this over-simplified formula. A lot of investors on paper are having good networth, but they never feel RICH or satisfied with what everyone thinks about them.

For example, imagine a person who lives in a house worth 2 crores (no loans) and also has another real estate worth 1 crore, plus mutual funds worth Rs 50 lacs.

Now, what is his/her net worth?

- Some will say that the person’s net worth is Rs 3.5 crores (2 cr+1 cr+ 50 lacs) as per our simple definition?

- Some will say that we shall not count his current house, hence it’s just 1.5 crores.

- And some may comment that because the real estate is not liquid enough, it shall just be seen as 50 lacs of networth?

- And what if this same person may also inherit shares worth 10 crores in the future? Then?

I hope you got my point. Just doing assets minus liabilities, gives you a one-point answer and that misses the details and gives you very superficial information.

4 categories of Assets

Recently, I created a framework using which it becomes simpler to visualize your networth. In this framework, the first step is to categorize all your assets into one of the 4 categories as below.

- Blocked – An asset is marked “blocked” if it’s not liquid and the money is blocked for many years. You can not liquidate, or do not wish to liquidate right now. However, in the future, you will liquidate it and use it for funding any goal.

- Free – An asset is marked “Free” if it’s possible to liquidate it in a few days/weeks and get the money in your bank account.

- Usable – An asset is marked “Usable” if it’s used for consumption purposes. So the house you live in shall mostly be counted as “Usable”. The gold jewelry at home shall be marked as “Usable”. However if you have a house where you live right now, but you know that in future, you will surely move to your home town and sell off the house or put it on rent, then that house shall be marked as “Blocked” and not “Usable”. A car can also be marked as “Usable” if you wish, however, it’s not recommended.

- Maybe – Another category is “Maybe”. An asset shall be marked as “Maybe” if you are unsure if it will come to you in the future or not. You do not want to count on it as of now, but if you are lucky, that will come to you. So any inheritance may be marked as “Maybe”. Some money which you gave as a loan to a friend may be marked as “Maybe”. However if you are very sure that its surely going to come to you, then you shall mark it as “Blocked” and not “Maybe”

Let me show you a sample data of how it looks like

| Asset Name | Current Worth | Type |

| MF (Equity) | 15000000 | Free |

| MF (Debt) | 1550000 | Free |

| Flat in Bangalore | 5500000 | Usable |

| Land in Hyderabad | 2000000 | Blocked |

| PPF | 4000000 | Blocked |

| EPF | 2876000 | Blocked |

| Shares | 3000000 | Free |

| Cash | 130000 | Free |

| Plot in Home town | 5000000 | Maybe |

| NPS | 5000000 | Blocked |

| Fixed Deposits (Inheritance) | 1000000 | Maybe |

| Loan to someone | 50000 | Maybe |

| Gold | 1500000 | Usable |

Note that if there is a home loan or car loan then please adjust the loan amount with the market value of the asset and only write the difference. So if a house is worth Rs 1 crore and the outstanding home loan is 40 lacs, then write value of house as only 60 lacs.

Visualizing your Assets

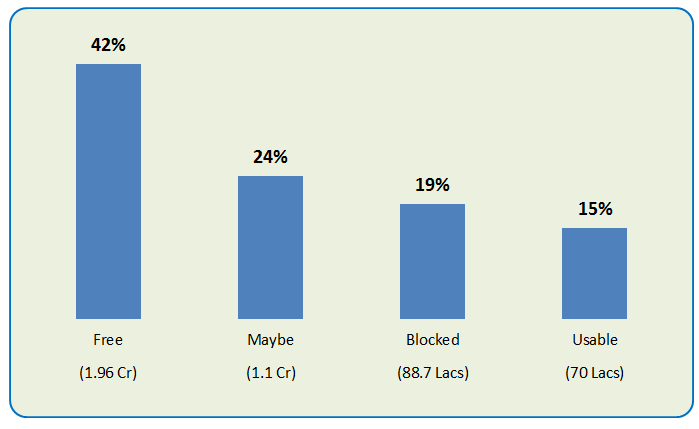

Once you categorize the assets into 4 types, you get clear information on how many assets you own in each category. It helps you a lot to make sense out of it.

Here you can see that by categorizing the assets into types, it’s so clear now that this person has a total of Rs 1.96 crores in those assets which are in Liquid form (FREE) and a major chunk of 1.1 crores (Maybe) is into assets that may or may not come to him. So it’s not very prudent to count on them for his future. If it comes to him/her, it’s a bonus.

Also, Rs. 88.7 lacs is blocked into various assets, so while all the relatives and friends consider it to be his net worth, it’s not available to him/her at the moment if need arises. So he is paper rich, but not in reality.

Also, Rs. 70 lacs is into those assets which is used for consumption purpose, which he will never liquidate for his goals (unless there is an emergency or in theory)

4 types of Networth

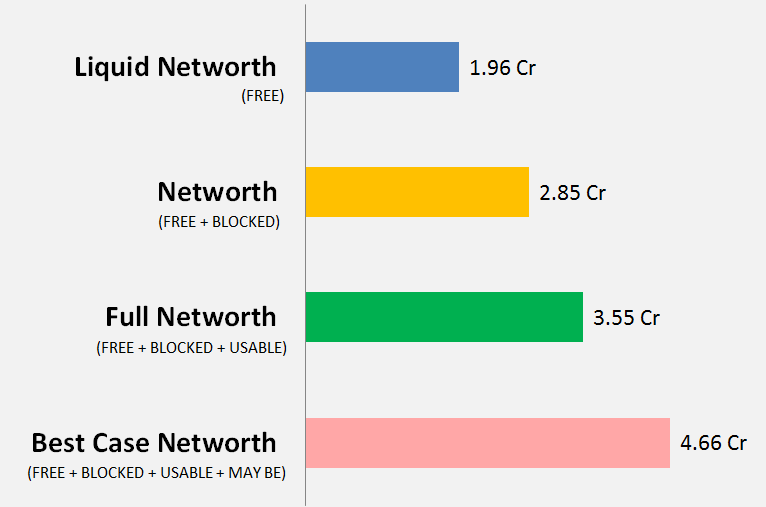

This brings me to the final and conclusive point – “What is his net worth”?

Here, we shall different kinds of networth rather than just looking at one single networth.

- Liquid Networth – You just add up all the FREE resources and call it your Liquid Networth. In the case above, its Rs 1.96 crores

- Networth – Add up your FREE and Blocked assets, which I will call “Networth” which totals to Rs 2.85 cr here, which is the traditional definition of net worth. I am not including the Usable and Maybe category of assets into this.

- Full Networth – This will include all your assets except the “Maybe” category. Full Networth means all assets which you own (either for investment or consumption), and you have full control over it. In this case, its Rs 3.55 cr

- Best Case Networth – This is the total of everything you own or can own in the future. This will be the same as full networth for those who don’t have any inheritance or assets which are probable to come to them. In this case, it’s Rs. 4.66 Cr

Here is what you shall do now

Put your assets in an excel sheet, and mark each one of them into FREE, BLOCKED, USABLE, and MAYBE. I am sure you will get a lot of clarity on how much of your assets fall in these categories and the various kinds of networth you have.

Do give me feedback if you liked this framework and if it helped you? This is just a framework and you can customize it as per your way of looking at things.